The choice between selling to a financial buyer or a strategic buyer can greatly impact the conditions and long-term results of a business sale. Sellers must carefully consider how these two buyer groups approach existing business purchases together, as they have different goals, investment horizons, and operational strategies.

Understanding Buyers

What is a Strategic Buyer?

A strategic buyer is a corporation that already operates in the same or similar industry and is seeking to expand by purchasing complementary businesses. Frequently, their main priority is taking advantage of the synergies between the acquired company and its current operations. This can entail strengthening their position in the market, lessening rivalry, or getting access to untapped markets, technological advancements, or clientele.

A strategic buyer might, for instance, place a higher value on a company’s operational effectiveness, intellectual property, or brand loyalty than on its short-term financial performance. Due to the potential for these synergies, strategic buyers tend to frequently have the willingness to pay a premium for the right business. Nevertheless, certain departments within the acquired business, especially those dealing with back-office infrastructure, may be eliminated due to post-acquisition integration.

What is a Financial Buyer?

On the other hand, financial purchasers are mostly focused on the acquisition’s possible financial benefits. These buyers include high-net-worth individuals, family offices, venture capitalists, and private equity organisations. They frequently assess companies as stand-alone entities, concentrating on factors including cash flow, growth potential, and the company’s capacity to make profits over a predetermined time frame—usually four to seven years.

Financial purchasers will carefully examine the company’s financial health to guarantee it can service that debt, as leverage (debt) is frequently used to fund a portion of acquisitions. When comparing their valuations to those of strategic buyers, they may be more conservative because they tend to focus more on financial indicators and projections.

Transaction Considerations

Investment Horizon

The investment horizon of each of these buyer groups is a crucial distinction. Usually, strategic buyers plan to fully integrate the company into their current operations and hold onto it for an extended period of time. As a result of corporate strategy and their long-term emphasis, they may be more resilient to transient business cycles or economic variations.

On the other hand, financial buyers frequently plan to sell the company within a few years, usually after expanding it or increasing its operational effectiveness. Given that acquisitions are the foundation of their business model, this shorter time horizon may increase their sensitivity to market risks and swings. Still, it may also enable them to execute deals more effectively.

Transaction Efficiency

Transaction efficiency is another factor that business owners need to consider. Financial buyers typically close deals more quickly and have extensive deal execution experience. Even while they might offer a greater purchase price, strategic bidders for private companies might have to deal with extra red tape, including board approvals and regulatory scrutiny—especially regarding antitrust rules.

Further, strategic purchasers in highly consolidated industries must be particularly aware of antitrust laws since additional consolidation can draw regulatory attention. In contrast, financial buyers tend to be less concerned with these rules because they usually do not work in the same industry as the businesses they purchase.

Choosing the Right Buyer

Strategic Buyers vs. Financial Buyers

A strategic or financial buyer may be selected depending on the seller’s objectives. A strategic buyer might be a better option if the seller prioritises maximising the sale price, providing the buyer with substantial synergies. On the other hand, a financial buyer would be more appropriate if the target company’s existing value is mostly derived from its capacity to produce cash flow and expand independently.

While financial purchasers will likely be more concerned with present profitability and growth possibilities, strategic buyers may be more ready to pay for intangible assets like brand strength or customer loyalty. Sellers must also consider the results of the acquisition: financial purchasers may maintain the business’s relative independence while strongly emphasising financial optimisation, whereas strategic buyers may fully integrate the company, maybe resulting in job layoffs or operational adjustments.

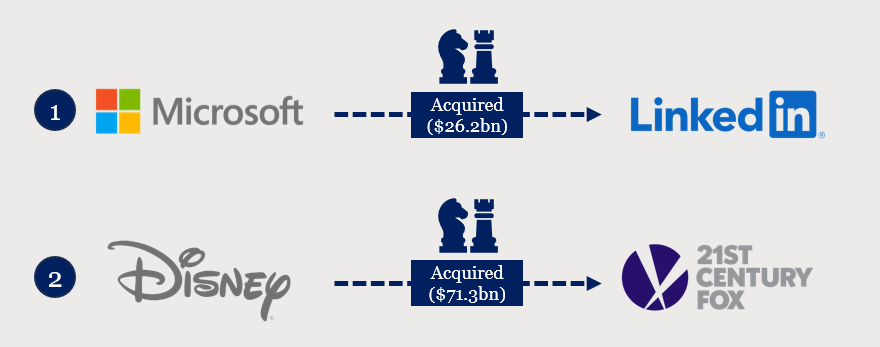

Real-Life Strategic Buyer Examples

1. Microsoft’s Acquisition of LinkedIn (2016)

Microsoft acquired LinkedIn for $26.2 billion to expand its professional networking reach and integrate LinkedIn’s vast user data with Microsoft’s enterprise tools. The acquisition allowed Microsoft to leverage synergies between its Office 365 suite of business operations and LinkedIn’s professional networking platform, providing better business insights and strengthening its cloud services and productivity software.

2. Disney’s Acquisition of 21st Century Fox (2019)

Disney purchased most of 21st Century Fox for $71.3 billion to gain a competitive edge in media content and streaming. By acquiring Fox’s vast library of films and TV shows, Disney bolstered its content offerings for Disney+ and its overall media empire, enabling it to compete more effectively in the evolving digital entertainment landscape.

Conclusion

To sum up, business owners who wish to sell their company must comprehend the distinctions between strategic and financial buyers. Various buyer types have different goals, approaches, and possible results in mind. Sellers can maximise their exit value and guarantee a more seamless transaction process by matching the buyer they choose with their personal objectives and their firm’s advantages.