In the realm of high-growth businesses and their valuations, the history of IPOs of technology companies has certainly raised eyebrows, especially with their astounding valuations and substantial losses. Take Uber, for instance, which reported a staggering $1.5 billion loss in the first quarter of FY19, right before its May 2019 IPO which valued the company at over $120 billion.

For Australian founders of high-growth businesses, such examples can lead to misconceptions regarding how investors assess fair value for their own ventures. A common misconception is that revenue growth alone drives value, disregarding the importance of building a sustainable company. However, this approach may ironically lead to the erosion of value over time.

To gain a better understanding of what truly drives value in a business, founders must dispel a few myths:

Myth 1: Valuation is an art

Contrary to popular belief, the valuation of a business, whether it’s a high-growth tech company or a small coffee shop, follows the same underlying framework called the ‘intrinsic value.’ This value is derived from three fundamental questions:

- How much cash will the business receive? (Amount)

- When will the business receive it? (Timing)

- How certain is this expected cash flow? (Probability)

Therefore, any strategic or operational decision made by the business should be evaluated through the lens of these three factors. Decisions that do not directly impact cash flows do not affect the business’s value. Moreover, for an asset to hold value, positive cash flows are essential over its lifespan, with earlier positive cash flows being more beneficial.

Investors, when objectively reviewing the probability of cash flows, consider factors like the management team’s quality, the path to achieving revenue and profit targets, the market landscape, and the barriers to entry for potential competitors. By focusing on this framework, founders can enhance the value of their businesses through a more scientific approach.

Myth 2: Valuation equals price

The famous value investor Warren Buffet has emphasized that “price is what you pay, value is what you get.” Hence, it’s crucial for value investors to understand that price and value are distinct entities. Investors may be driven by market sentiment, seeking to invest in what’s considered hot and trendy. The success of Silicon Valley giants like Google and Apple has further fueled this sentiment, creating a fear of missing out on the next big opportunity. Consequently, prices may deviate from the actual intrinsic value of a business.

To justify the price they paid, investors may expect the business to grow at an exceedingly fast rate, potentially leading to significant cash burn. Not all companies can sustain this approach, unlike some well-funded firms like Uber and Lyft with their rapid market expansion. The key takeaway here is to always consider value over price. Strategic decisions should be based on maximising value, rather than solely focusing on short-term price movements.

Myth 3: Risk is bad

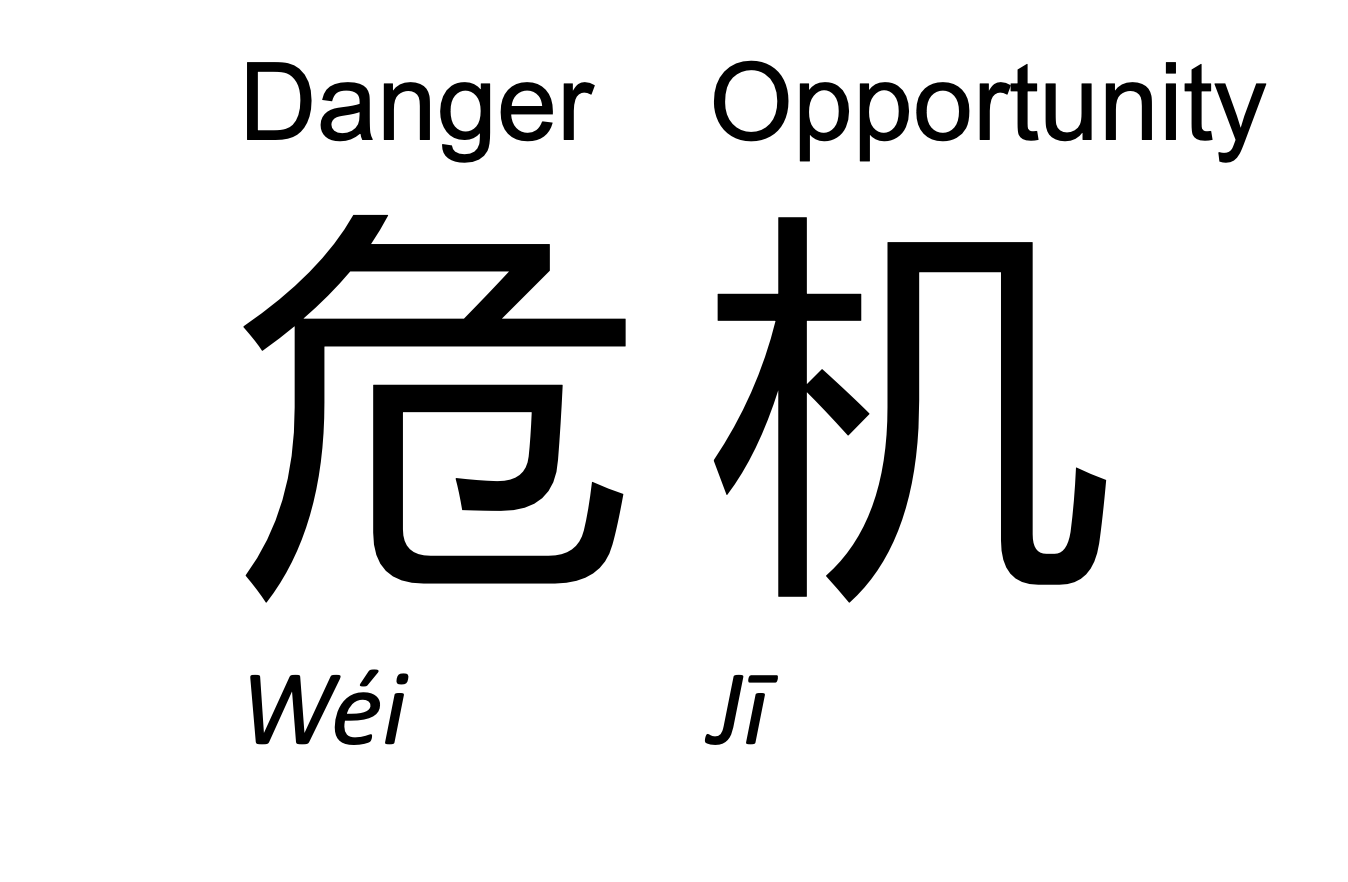

In financial terms, risk is a bit more complex than the common perception of a negative outcome. The Chinese word for risk, ‘wei ji,’ is more fitting in its definition.

It refers to the degree of danger an investor is willing to tolerate to seize an opportunity. When assessing risk, investors look at the likelihood and severity of potential risks and available mitigations.

Business owners should comprehend and transparently communicate the risks inherent in their business model, as these risks can influence the probability of cash flows. This ensures that investors are matched appropriately to the risk profile of the investment opportunity.

Throughout a business’s lifecycle, pivotal decisions can shape its trajectory. Keeping the principles of value maximisation in mind during these critical choices will aid in securing long-term success.

At Greenwich, we believe in patient capital and strategic collaboration, adding genuine value at every step of the journey. Are you ready to join the next generation of Australian companies in shaping the future?