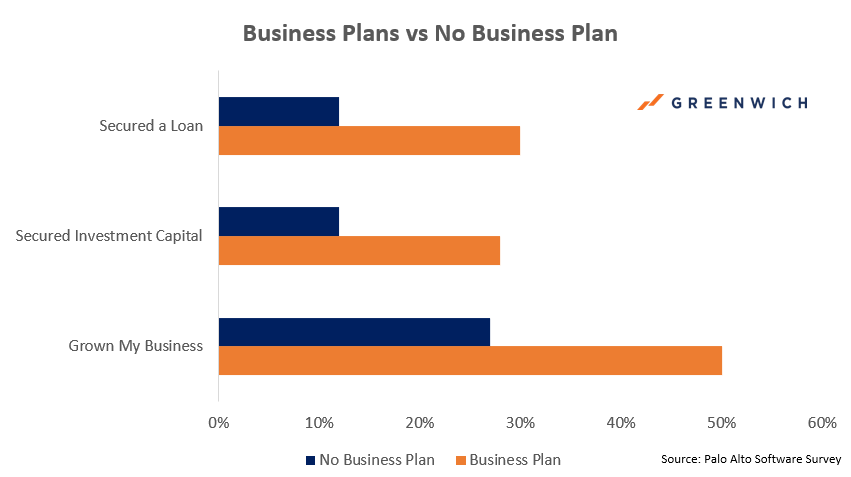

A winning business plan is imperative. As the chart below shows, having a business plan improves the chances of a business securing funding.

A capital raise refers to the process by which a company seeks to secure additional funding from investors in exchange for an ownership stake, typically through the sale of shares or equity. Prospective investors require a well-thought-out business plan highlighting clear investment themes before allocating their capital, as this plan will ultimately provide a sense of comfort and excitement for the firm’s future growth. The following piece will uncover each element of a winning business plan and explain why they are paramount for a successful capital raise.

Executive Summary

An executive summary is a concise, digestible snapshot of a winning business plan, encapsulating its essential elements and value proposition. This section will provide potential investors with a clear overview of the business plan’s key strategic direction through qualitative avenues such as a mission statement, target market, product or services and competitive advantages. Conversely, the summary will quantitively highlight the business’ critical financial projections (revenue, expenses, profitability) that ultimately arrive at the crescendo of how much capital is being sought and how it plans to be allocated. Therefore, the executive summary is a crucial stepping stone to provide prospective investors with context and visibility of a winning business plan before diving into further detail.

Company Description

A company description is a vital aspect of a business plan that aims to reveal a firm’s history, legal position and capital structure (ownership makeup) in more detail. A company description allows one to showcase the business’ mission, vision and values. This provides an opportunistic avenue to foster an emotional connection with prospective investors by showcasing why the firm exists and its purpose.

Furthermore, this section affords the ability to provide insight into what the business’s products or services are, their benefits to the consumer and why the value proposition is unique. This is crucial for potential shareholders in a capital raise because it allows them to evaluate the business’s alignment with their investment goals and assess long-term profitability and growth potential.

In summary, the company description serves as a multifaceted gateway in a winning business plan, offering a window into the business’ essence and solution to achieve strategic outcomes for both the consumer and investors.

Market Analysis

Market analysis represents a critical chance to inform further what specific market is being addressed and why it is attractive to target. A robust rationale for why a particular market is targeted is a crucial insight for investors to understand where their capital will go and what characteristic features the sector exhibits.

Additionally, market analysis provides scope for analysis of the targeted industry’s key trends and challenges. At a time of high-interest rates, sticky inflation and unforeseen systematic risks, all businesses find themselves in a challenging economic environment, with individual industries harbouring unique risks in the foreseeable future. Therefore, prospective investors must know that one’s firm has a clear plan to eliminate these risks or at least have strategic measures to mitigate/safeguard against them.

Lastly, the market analysis includes a crucial juncture for illustrating to potential investors an understanding of who the main competitors are and how the business can differentiate itself with a superior product/service to those in the market.

Thus, market analysis is a pivotal component of a winning business plan that sheds light on the operating market and ticks crucial boxes for prospective shareholders that the firm has a clear comprehension of the economic and industry-specific landscape in which it operates.

Competitive Analysis

The competitive analysis section often includes detailed, firm-specific analysis that further develops prospective investors’ comfortability with understanding the competitive landscape the business operates in.

A SWOT analysis is a strategic framework that assesses a company’s internal strengths and weaknesses and external opportunities and threats. The framework mentioned above enables a business to present a structured method of evaluating key market and firm-specific forces that ultimately drive strategic decisions. This section of a winning business plan should methodically articulate to prospective investors how exactly the firm’s product or services meet the needs of one’s target market.

Expanding on the previous point, a winning business plan should inform prospective investors of a clear competitive strategy and how exactly this strategy will be applied to help foster and maintain an advantage over rivals in the industry.

To sum up, before allocating capital, all prospective investors will require a business to have well-informed strategic trajectories that address the firm’s operational forces and the broader market.

Products or Services

A business’ product or service (referred to as a firm’s “offering” in this paragraph) is essentially the strategic lifeblood that long-term success is underpinned. As a result, a winning business plan will utilise this section to provide prospective investors with a detailed description of the firm’s offering.

The description should include critical aspects of the offering, such as features, benefits and the unique selling proposition. Furthermore, the description will showcase how the business leverages the needs and requirements of one’s target market.

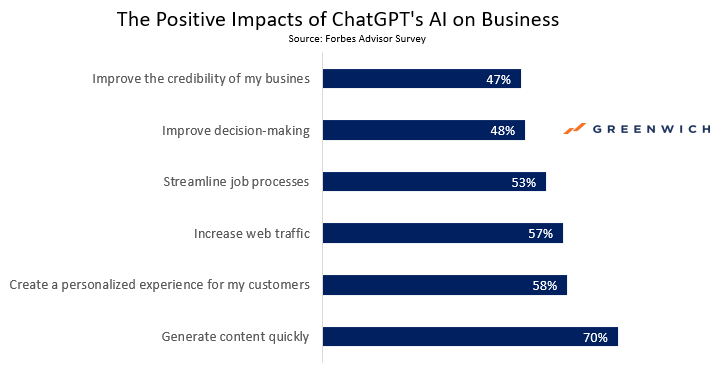

Additionally, prospective investors will apply a large amount of weighting on knowing that the company they invest in has an ever-evolving product that is constantly adapting to a shifting economy. This can be achieved through a detailed product development roadmap that showcases how the business plans to innovate, adapt and expand the offering in the future. For example, artificial intelligence (AI) is a topic on every news site worldwide that almost every business can apply to improve their offering or gain superior efficiencies in an operational context. Innovative technology like AI is not the first and won’t be the last disruptive technological innovation to sweep worldwide. Prospective investors must clearly see that one’s business is positioned to leverage innovative resources to evolve its offering constantly.

Sales and Marketing Plan

A sales and marketing plan is essential to a winning business plan as it outlines how one’s business intends to attract customers, grow revenue, and compete effectively in the market. Prospective investors will give merit in seeing how a business plans to establish a unique market position, allocate resources wisely, and set measurable objectives.

Furthermore, this section should outline to prospective investors key pricing strategy dynamics. An effectively crafted pricing strategy, which accounts for product cost structure and market price sensitivity, is a crucial form of planning that will show investors a clear pathway to revenue growth and profit maximisation.

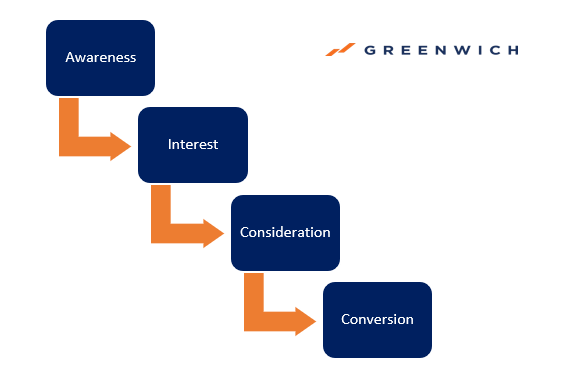

In addition, a clear outline of a business’s sales funnel and customer acquisition processes is vital information for prospective investors in a winning business plan. A sales funnel visually represents the customer journey, from initial awareness of the firm’s offering to the final purchase. This is often structured with different stages: awareness, interest, consideration, and conversion. A winning business plan will effectively showcase strategic initiatives for each stage of the customer lifecycle to prospective investors and how the firm plans to seamlessly flow potential consumers from interest to conversion.

To sum up, incorporating a robust marketing and sales plan into a business plan will demonstrate to prospective investors the company’s adequate planning and convey competency in the brand’s long-term growth and customer base.

Management Team

A business draws striking parallels to an old shipping vessel. Unforeseen challenges, such as bad weather, delays, and changes in plans, can arise along the journey from point A to point B and beyond. Ultimately, the success of the voyage and how well the crew responds to these unforeseen challenges comes down to the captain and their lieutenants (the management team).

A winning business plan must convey to prospective investors how one’s management team is qualified (past experiences) to execute the business plan, respond to harsh market conditions, and ultimately achieve the firm’s strategic goals. Additionally, a winning business plan should provide insight into compensation across the business and its benefits structure.

Therefore, a detailed analysis of a business’ management team will equip prospective investors with a window of transparency into the competency of the team’s leadership, establishing a level of trust and confidence before committing to an investment.

Business Operations Plan

An operational plan provides prospective investors with an internal perspective on the production process, supply chain management and customer service. This section of a winning business plan will provide investors with a window into the company’s operational efficiency, demonstrating how well the business can manufacture and deliver its offering cost-effectively. Due to the interconnected nature of a business’ departments, operations directly impact profitability.

Therefore, this section must convey to investors that clear strategic plans are in place to ensure fluid and efficient processes. Moreover, as mentioned earlier in this piece, businesses face a challenging economic environment at the present moment. An operations plan should, therefore, include the firm’s risk management strategy. Prospective investors will be well aware of the challenging economic setting.

As a result, more than ever before investment, investors will require a business to have a defined and clear strategic direction on how they plan to mitigate these risks with a vigorous risk management framework.

Financial Plan

The financial plan represents one of the most essential parts of a winning business plan. This section should quantitively convey to prospective investors financial projections of one’s business, including revenue, expenses and profitability. A higher depth of analysis can be beneficial, down to the unit economics of the business offering and a clear depiction/explanation of diversified revenue streams if applicable. While most of this information can be sourced from a financial model, strategic insights should be converted into effective presentation mediums. This could be achieved through graphs, charts and diagrams, allowing for the seamless conveyance and emphasis of key points.

Furthermore, the financial plan should adequately explain to prospective investors how the firm intends to utilise and allocate the capital sought. Articulating the strategic allocation of the capital sought from investors is a critical element of a winning business plan. This will demonstrate a deep understanding of the capital’s purpose and effective resource utilisation, which is instrumental in fostering investor confidence and aligning objectives.

Finally, a winning business plan must explain the firm’s exit strategy and how investors can expect to earn a return on their investment. This will assure investors of the business’s long-term viability and define potential future scenarios, reducing prospective investors’ uncertainty. For example, an exit strategy might detail plans for an initial public offering (IPO), acquisition by a larger company, or a management buyout, giving investors confidence that management knows shareholders’ interests and the business itself.

In summary, the financial portion of a winning business plan represents an opportunity to dive deep into the quantitative value proposition of one’s business, which will not only enhance transparency and trust but also reiterate the intent and commitment of investor success to potential shareholders.

Appendix

Often overlooked, the appendix section of a winning business plan is paramount to investors. In preparation for a capital raise, a winning business plan must balance providing detailed, sophisticated insight while retaining the momentum of the firm’s story and overall business vision for potential investors.

The appendix, therefore, provides an opportune system for incorporating supporting documentation. For example, a company could provide further detailed analysis of topics/points referenced in the plan, such as market research reports, financial statements/models, and product prototypes. Consequently, the appendix presents an invaluable aspect of a winning business plan in the capital raise context. It empowers investors to continue further analysis with a more profound scope outside the main sections, ultimately reducing uncertainties, increasing trust/confidence and promoting well-informed decisions.

Conclusion

In the business world, a well-crafted and adequately detailed winning business plan is the cornerstone of success when raising capital from possible investors. The structure and content discussed in this piece serve as a blueprint for a winning business plan and a persuasive framework. This plan aims to instil trust, optimism, and excitement in potential investors about the business conducting a capital raise while identifying pathways to exit and, ultimately, return on investment.