Introduction

Many different factors go into a business owner’s decision to sell. Although financial incentives frequently have a big impact, psychological factors also matter. Knowing why you’re considering a sale is important.

Whether it’s as part of a planned exit or as a result of shifting personal circumstances, determining the exact motive can be vital to successfully navigating the process. Selling a business doesn’t have a one-size-fits-all strategy, so you must adjust your plan to match your unique circumstances.

This article will examine the most frequent causes of business sales and offer insight into how this may affect the sale process.

1. Retirement

Retirement is one of the most common reasons business owners sell their companies. After years, or even decades, of hard work and dedication, many entrepreneurs look forward to enjoying their golden years free from the demands of running a business. This transition allows one to focus on personal interests, family, and leisure activities.

At Greenwich, we have encountered numerous business owners who are ready to retire but are deeply concerned about finding the right buyer to uphold their companies’ legacy.

Retirement doesn’t mean the end of a business’s journey; with careful planning and the right buyer, it is possible to ensure that the business continues to thrive and positively impact society.

By identifying buyers with the same values and vision, business owners can retire knowing their work will be preserved and their companies will continue to contribute meaningfully to their communities and industries.

2. Owner Has Taken Business As Far As They Can

The next reason owners may decide to sell their business is that they have taken the company’s growth as far as possible. This typically means that the current owner has maximised their resources, expertise, and capabilities to grow the business to its current state.

However, further growth may require new skills, innovative strategies, or additional capital the owner cannot provide. In such cases, selling a portion of the business to a strategic partner can be transformative. This partnership can introduce new expertise, advanced technologies, and significant capital, enabling the business to reach new heights and markets previously unattainable. This strategic collaboration not only propels the business into its next stage of growth but also ensures that. The original owner’s legacy is preserved and built upon.

3. Lifestyle Change

The next reason we will look is often seen across the business industry as a desired lifestyle change. After dedicating years to the demanding business world, many owners seek a different pace of life, prioritising personal well-being, travel, or spending more time with family.

This shift often means stepping away from the daily business responsibilities and stress. Selling the business can provide the financial freedom necessary to support this new lifestyle. Moreover, finding the right buyer ensures that the business continues to operate successfully, maintaining its contributions to the community and industry. This transition allows owners to embrace a new chapter in their lives while securing the future of their business legacy.

4. Financial Reasons

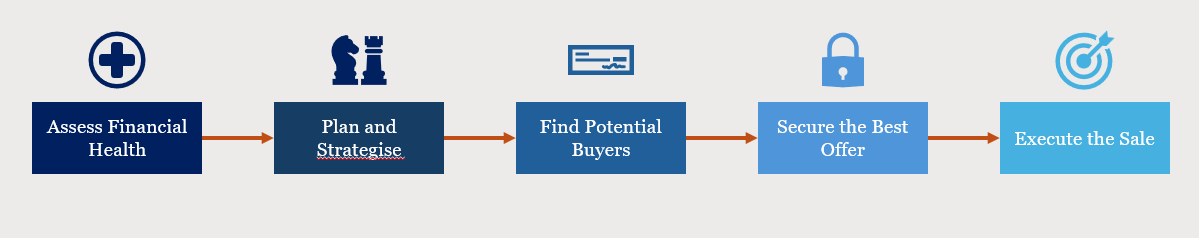

Financial challenges can significantly hinder your business operations, potentially making it untenable to continue as an owner. Stagnant or declining revenue and profits can create a difficult financial landscape. Selling your business with a well-thought-out strategy can greatly improve your financial standing. Key priorities during this process include securing a strong offer.

Achieving the best possible price requires meticulous planning, research, and execution. It’s crucial to ensure that your business’s finances are in order and enhance prospective buyers’ due diligence experience. Additionally, making your business operationally independent from your direct involvement can increase its appeal.

If you’ve maximised your business’s potential with your current skills and resources, selling might be the best way to avoid major risks and achieve financial stability. A notable example from Australia is Bindaree Beef, a New South Wales-based beef processing company. In 2017, Bindaree Beef sold a 51% stake to Archstone Investment, a firm led by wealthy Hong Kong-based Australian citizens.

This strategic partnership was crucial for Bindaree, which had sought investment for several years due to financial difficulties. The capital infusion from Archstone Investment provided the necessary funds to expand operations, upgrade facilities, and enhance their supply chain and distribution networks. This move allowed Bindaree Beef to grow its domestic and international market presence, ultimately stabilising and priming the business for a significant growth stage.

5. Capitalise On The Market

5. Capitalise On The Market

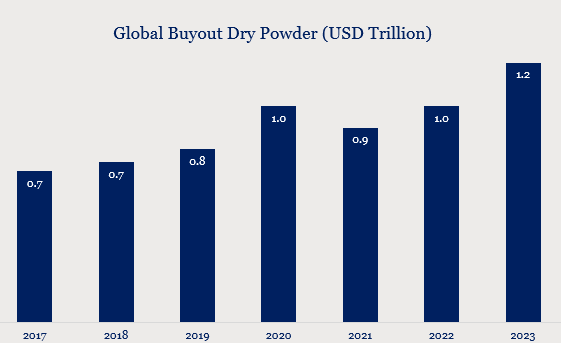

Capitalising on the market means taking advantage of economic conditions to achieve the best possible outcome for selling your business. When market conditions are right, such as high demand for acquisitions or abundant available investment capital, sellers can often secure higher prices and better terms.

Private equity firms are experiencing record levels of “dry powder,” which refers to the capital that investors have committed to firms but has not yet been allocated. According to a Bain & Co. report, global private equity dry powder reached approximately $2.5 trillion in 2023. This substantial amount of undeployed capital means that private equity firms actively seek investment opportunities, making it a time for business owners to consider selling.

By strategically timing your sale, you can leverage this market liquidity to achieve a more favourable financial outcome and ensure your business continues to thrive under new ownership.

Global Private Equity Report 2024 – Bain & Company

Conclusion

In conclusion, selling a business is a significant decision influenced by various factors, including the desire for retirement, financial challenges, lifestyle changes, or the need for fresh expertise to drive further growth.

Understanding these motivations can help business owners develop a strategic exit plan that ensures a smooth transition and preserves their business’s legacy. By carefully selecting the right buyer, owners can secure financial stability and ensure their business continues to thrive and positively impact society.

A well-executed sale benefits the original owner and sets the business on a path for continued success and growth under new leadership.

How Greenwich Can Help