Introduction

As a business owner, there comes a time when you are looking to sell your business. Perhaps you’ve achieved your long-term objectives, or maybe it’s time to realise the value you have built.

Transparency is paramount throughout the sales process, beginning with being upfront about your motivation for exiting. Potential buyers will naturally be curious about why you’re letting go of a thriving business. By openly communicating your reasons, you establish trust and set the stage for a smooth and collaborative transaction.

There are many reasons why business owners decide to sell. Some may be looking forward to a well-deserved retirement. For others, the allure of a fresh challenge or a career change might be a driving force. In some cases, unforeseen circumstances like ill health may necessitate a change in ownership. You may also feel you’ve taken your business as far as it can go under your leadership and that your team and the company could benefit from new ownership and fresh perspectives.

Regardless of your motivations, navigating the intricacies of a business sale can be complex. For instance, here are some common questions when business owners are faced with the conundrum:

- What is the end-to-end process, and how much time do I need to devote?

- How much is my business worth?

- What legal and tax implications must I consider when selling my business?

- How do I find the right buyer to value my company and continue its legacy?

As with selling a house, you can find qualified professionals to help you. However, just like the real estate market, there are many different ways and services that can help you sell your business directly or indirectly.

There are generally two types of services that help in selling your business: business brokers or corporate M&A advisors. What are the differences between the two, and which is more suitable for me? Read on to find out more.

Who Can Help Me to Sell the Business?

Choosing the right advisor hinges on the size and complexity of your business sale. Business brokers typically cater to smaller or “high street” businesses with lower sale values. Using the real estate analogy, business brokers function similarly to local realtors specialising in your neighbourhood. They often specialise in a specific industry or geographic region and focus on tasks like marketing your company to potential buyers, conducting basic financial analysis, and facilitating negotiations. Their process is more transactional, and they may not delve into complex due diligence or intricate deal structuring.

In contrast, M&A advisors manage more intricate transactions involving mid-market or larger companies with a national or international reach. They can handle mergers and acquisitions in addition to business sales. M&A advisors offer a broader range of services, including services like in-depth business valuation (akin to a detailed home appraisal), pre-sale preparation (comparable to renovations and staging), meticulous buyer identification and qualification, managing the due diligence process, crafting strategic negotiation tactics, and planning for post-sale integration. Their expertise often spans finance, law, and business negotiations, allowing them to navigate the intricacies of the sale and maximise your return on investment.

Do I Need an M&A Advisor?

While you can technically navigate a business sale independently, there are significant advantages to partnering with an M&A advisor. Here’s a breakdown of the pros and cons to consider:

Pros

Expertise and Experience

Advisors bring extensive knowledge of the M&A process, financial analysis, negotiation tactics, and the intricacies of due diligence. They can guide you through the complexities of the sale, maximising your return on investment and minimising potential pitfalls. For instance, an advisor can anticipate and address issues that might arise during due diligence, such as unexpected liabilities or environmental concerns.

Time Efficiency

Selling a business can be a time-consuming undertaking. Advisors can handle the heavy lifting, freeing you to focus on running your business and minimising disruption to your day-to-day operations. Imagine negotiating with multiple buyers while managing a team and making sales to the market. An advisor can manage buyer interactions, allowing you to focus on core business functions.

Confidentiality and Discretion

Maintaining confidentiality during the sale process is crucial. Advisors can discreetly market your business to qualified buyers, protecting sensitive information. This is especially important if you’re concerned about your competitors learning that your business is on the market.

Wider Buyer Pool

Advisors have established networks and access to a broader pool of potential buyers, increasing the chances of finding the perfect fit for your company. Consider an advisor like a high-end real estate agent who can attract qualified international buyers for your luxury property.

Cons

Cost

An advisor’s services come at a cost, typically in the form of a retainer, commission based on the sale price, or a combination of both

Potential Loss of Control

Hiring an advisor necessitates some relinquishing of control over the sale process. However, a good advisor will keep you informed and involved in key decisions.

In many cases, partnering with an advisor is the optimal choice. This is especially true if:

- Your Business is Complex: An advisor’s expertise in navigating the sale process becomes invaluable for mid-sized or larger businesses with intricate operations or financial structures.

- You’re New to M&A: If you lack prior experience with mergers and acquisitions, an advisor can provide the essential knowledge and guidance to ensure a successful sale.

- Confidentiality is Paramount: Advisors are adept at discreetly marketing your business to qualified buyers, safeguarding sensitive information and preventing unwanted attention from competitors.

- Due diligence can be daunting: An advisor can anticipate potential issues, prepare you accordingly, and ensure a smooth process.

- Finding the Perfect Buyer is Crucial: When finding the right buyer is paramount, an advisor’s access to a wider pool of qualified candidates and their negotiation expertise can significantly increase your chances of a successful outcome.

How to Choose Between Advisors for the Sale of a Business?

Choosing the right advisor is crucial for a successful and stress-free business sale. Here’s a breakdown of key criteria to consider when making your selection:

Experience

Look for an advisor with a proven track record of successful transactions in your industry and size range. Ask about their experience with similar businesses and the outcomes they achieved. A qualified advisor brings a wealth of knowledge and experience to the table. They understand the nuances of the M&A process, from valuation and financial analysis to negotiation tactics and due diligence procedures. This expertise helps you confidently navigate the sale’s complexities, ensuring a smooth and efficient process.

An advisor’s value extends beyond technical expertise. Their experience allows them to anticipate and address unforeseen challenges during the sale process. They can also provide valuable guidance on the emotional aspects of selling a business, such as managing expectations and navigating the transition period.

Network

While experience is undoubtedly essential, another frequently overlooked factor can significantly impact the outcome – the advisor’s network. This network, a well-established web of connections with potential buyers, becomes a strategic advantage in your business sale, maximising your chances of a successful transaction.

Imagine attempting to sell a property independently. You might list it online and display a sign, hoping for a suitable buyer. However, an experienced real estate agent possesses a vast network of potential buyers, actively marketing your property to those most likely interested. Similarly, an advisor’s network extends far beyond your reach, granting access to:

- Strategic Buyers: These companies seek acquisitions within your industry to expand their market share, product offerings, or geographical footprint. An advisor with strong ties to strategic acquirers can connect you with the ideal buyer who recognises your company’s value proposition.

- Private Equity Firms: These firms invest in promising businesses, often providing the capital and expertise to fuel further growth. An advisor with established relationships with private equity players can open doors to attractive investment opportunities, potentially exceeding offers from traditional buyers.

- High-Net-Worth Individuals (HNWIs): Wealthy individuals are often interested in acquiring established businesses. An advisor who understands the specific investment criteria of HNWIs can attract these potential buyers, leading to competitive offers.

- Industry Experts: These individuals provide valuable insights into the current landscape of your industry and potential buyer behaviour. An advisor with a network of industry experts can leverage this knowledge to tailor the marketing strategy and attract the most suitable buyers.

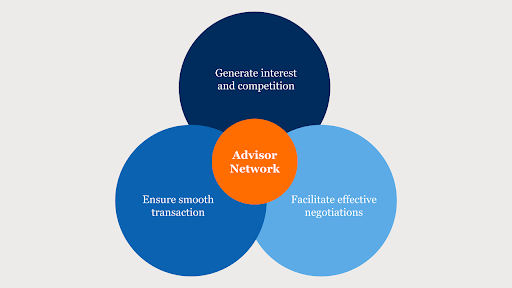

An advisor’s network goes beyond simply introducing you to potential buyers. They can leverage these connections to:

- Generate Interest and Competition: Advisors can utilise their network to create a buzz around your business, generating interest and potentially driving up the sale price through a competitive bidding process.

- Facilitate Effective Negotiations: With established relationships, advisors can strategically navigate negotiations, advocating for your best interests and securing favourable terms.

- Ensure a Smooth Transaction: A strong network fosters trust and understanding between all parties involved. This can lead to a smoother due diligence process and a faster closing, minimising disruption to your business operations.

Reputation

Research the advisor’s reputation within the industry. Talk to past clients and get their perspectives on the advisor’s effectiveness and communication style. Positive testimonials from past clients who have benefited from the advisor’s experience and expertise can be invaluable indicators of their effectiveness.

Fees and Structure

Comparing advisory fees and services for your business sale requires careful analysis to ensure you get the best value. Here are some factors to consider:

Understanding Fee Structures

-

- Break it Down: Advisors typically have different fee structures. Ask for a detailed breakdown of their fees, including:

- Retainer: A fixed upfront fee to secure the advisor’s services for a specific period.

- Success Fee: A percentage of the final sale price, incentivising the advisor to achieve a high return.

- Transaction Fee: A flat fee paid upon successful completion of the sale.

- Compare Apples to Apples: When comparing fees, ensure you understand the services included in each advisor’s proposal. Some may offer a wider range of services within their fee structure, while others might require additional fees for specific tasks like due diligence support or post-sale integration planning.

- Break it Down: Advisors typically have different fee structures. Ask for a detailed breakdown of their fees, including:

Evaluating Services:

-

- Go Beyond the Fee: Don’t solely focus on the lowest fee. The most expensive advisor might not be the best fit, but a cut-rate option could lack the experience or expertise needed to maximise your return.

- Align Services with Needs: Assess the services offered by each advisor and ensure they align with the complexities of your sale. For instance, a simple sale of a small business might not require the in-depth due diligence support needed for a larger, more intricate transaction.

Here are some questions you can ask potential advisors to help you choose the best fit for your business sale:

Understand Your Business:

- Can you walk me through your initial process to understand my business, its unique value proposition, and its target buyer profile?

- How will you comprehensively understand my company’s financial health and future growth potential?

Sales Strategy and Timeline:

- Can you outline your proposed timeline for the sale process, including key milestones and potential roadblocks?

- What marketing strategies will you use to attract qualified buyers for my business?

- How will you handle buyer communication and manage multiple offers, if applicable?

Your Role in the Process:

- What level of involvement can I expect from you throughout the sale process?

- How will you inform me of developments and ensure clear communication at every stage?

- How will you approach my goals and priorities when negotiating the final deal terms?

By asking these questions, you better understand the advisor’s approach, communication style, and how they plan to tailor their services to your specific needs and business. This will empower you to make an informed decision and select the advisor who will become a trusted partner in navigating the complexities of your business sale.

What Are the Stages of a Buy-Side Mandate?

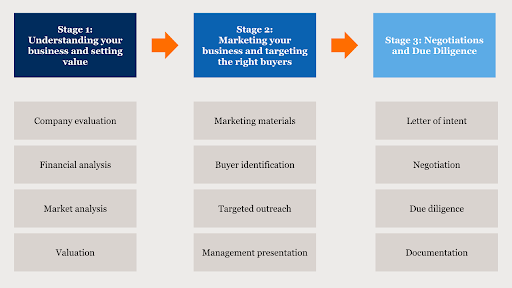

Stage 1: Understanding Your Business and Setting Value

The initial stage focuses on internal analysis and establishing a realistic valuation for your business. This critical step involves:

- Company Evaluation: Your advisor will collaborate with you to conduct a comprehensive analysis of your business, assessing its financial health, market position, operational efficiency, and growth potential.

- Financial Analysis: Your financial statements are thoroughly reviewed to determine profitability, growth trends, and key financial ratios that attract potential buyers.

- Market Analysis: Your advisor will analyse your industry landscape, including competitor valuations, recent M&A activity, and market trends that may influence your valuation.

- Valuation: Using industry-standard methodologies and considering the company’s findings and market analysis, your advisor can help you form a realistic valuation range for your business.

Why it’s important: Clearly understanding your company’s strengths, weaknesses, and market value is crucial for setting realistic expectations and attracting qualified buyers. An accurate valuation ensures you don’t undersell your business while remaining competitive.

Stage 2: Marketing Your Business and Targeting the Right Buyers

Once you clearly understand your business value proposition, your advisor will develop a targeted marketing strategy to attract potential buyers. This typically involves:

- Marketing Materials: Your advisor will craft compelling marketing materials, including a confidential information memorandum (CIM) that showcases your company’s strengths, financials, and growth potential.

- Buyer Identification: Leveraging their extensive network and industry knowledge, your advisor will identify a pool of qualified buyers, including strategic acquirers, private equity firms, and high-net-worth individuals.

- Targeted Outreach: The advisor will conduct a targeted outreach program, reaching out to potential buyers who are a strategic fit and have a demonstrated interest in your industry or business model.

- Management Presentations: Your advisor will coach and prepare you for management presentations to potential buyers, ensuring you effectively communicate your company’s value proposition.

Why it’s important: A well-crafted marketing strategy and targeted outreach ensure your business is presented to the right audience – potential buyers who are most likely to be interested and offer a strong purchase price. Effective management presentations allow you to connect with buyers personally and further solidify your company’s value.

Stage 3: Negotiations and Due Diligence

Following the initial buyer interest, negotiations commence. This stage involves:

- Letter of Intent (LOI): Qualified buyers will submit a non-binding Letter of Intent (LOI) outlining their initial offer, terms, and timeline for due diligence.

- Negotiation Strategy: Your advisor will develop and guide you through a strategic negotiation process, aiming to secure the best possible price and terms for the sale.

- Due Diligence: Selected buyers will conduct a comprehensive due diligence process by examining your company’s financial records, legal standing, and operational processes. Your advisor will facilitate this process while ensuring confidentiality.

- Legal Documentation: Your advisor will work with your legal counsel who will draft and finalise the definitive purchase agreement and other closing documents. The advisor’s role will be to ensure that all the key terms that were negotiated are captured in the legal agreements.

Why it’s important: Effective negotiation requires understanding buyer motivations and strategically positioning your business to maximise its value. A skilled advisor can help you navigate this complex process and secure the best possible outcome. Due diligence allows buyers to make an informed decision and ensures a smooth transaction for all parties involved.

Conclusion

Selling your business is a significant milestone, and the road to a successful sale can be exciting and complex. You can confidently approach the process by understanding the key stages involved, from initial planning and valuation to targeted marketing, negotiation, and due diligence. Remember, partnering with a qualified M&A advisor with industry expertise and a proven track record can be invaluable. Their guidance can help you navigate the complexities of the sale and maximise the value you receive for your business in several ways:

- Expertise and Objectivity: M&A advisors bring in-depth knowledge of the market, valuation methodologies, and the intricacies of the deal process. Their objective perspective helps you avoid emotional decision-making and ensures you approach negotiations with a clear head.

- Strategic Planning and Marketing: Advisors can help you develop a targeted marketing strategy to attract the right buyers and effectively position your business for a premium valuation. Their extensive network and industry knowledge can open doors to potential buyers you might not have reached alone.

- Negotiation Powerhouse: Skilled advisors possess strong negotiation skills and can advocate for your best interests. They can help you navigate complex deal structures and secure the most favourable terms for your sale.

- Due Diligence Facilitation: Advisors can streamline the due diligence process, ensuring a smooth exchange of information and addressing buyer inquiries efficiently. This minimises disruption to your business operations and helps expedite the sale.

Ultimately, a qualified M&A advisor acts as your trusted partner throughout the sale process. Their expertise, guidance, and unwavering dedication to your success can make all the difference in achieving your exit goals. So, whether you’re actively seeking a buyer or simply contemplating the possibility of a future sale, equip yourself with knowledge and explore the possibilities. The decision to sell your business is ultimately yours, but a well-informed decision with the support of a skilled advisor paves the way for a successful and rewarding outcome.