Management Buyouts (MBOs) are a strategic exit option for owners seeking to exit their businesses.

What is a Management Buyout?

A Management Buyout (MBO) is a transaction where a company’s management team purchases a significant part or all of the company from its current owners. MBOs are a strategic exit option for owners seeking to exit their businesses.

Management Buyouts are often used when the current owners wish to retire or step away from day-to-day operations. They offer a smooth transition with people familiar with the business’s inner workings. This route ensures continuity for employees and customers and empowers management teams to implement their vision directly, backed by their deep understanding of the company.

Reasons for considering a Management Buyout

An MBO can be a compelling option for businesses due to a variety of reasons beyond retirement, succession planning, or a desire for new ventures. Here are some additional factors to consider:

Financial Benefits and Growth Opportunities

- Increased Value: A well-executed MBO can significantly increase the value of a business. By leveraging the management team’s expertise and dedication, the company can often achieve higher growth rates and profitability.

- Debt Reduction: MBOs can be used to reduce or eliminate existing debt. This can improve the company’s financial health and provide greater flexibility for future investments.

- Employee Ownership: In cases where an MBO involves employees becoming partial owners of the business, this can boost morale, increase employee engagement, and foster a stronger company culture.

Strategic Advantages and Risk Mitigation

- Preservation of Company Culture: Management teams are often deeply invested in the company’s culture and values. An MBO can help preserve this culture and prevent significant disruptions that might occur under new ownership.

- Continued Customer Relationships: Existing management teams have established relationships with customers, suppliers, and other stakeholders. An MBO can ensure that these relationships remain strong and contribute to the company’s ongoing success.

The Role of the Management Team

Existing Management Team vs. New Management Team

In a management buyout, the existing management team are already familiar with the business and can continue to lead the company, providing a seamless transition for future development. Alternatively, a new management team may be brought in to offer fresh perspectives and expertise. The choice will depend on the specific circumstances and the seller’s preferences.

The Importance of a Strong Management Team in MBOs

A strong management team is essential in any management buyout. The management team pools resources to gather financial backing and acquire part or all of the business they oversee. It drives the buy-in management buyout process, liaises with financial partners, and ensures a seamless transition. This team’s experience, skills, and leadership capabilities significantly impact the management buyout’s success.

Private Equity Firms and Funds

Private Equity Firms: Key Players in MBOs

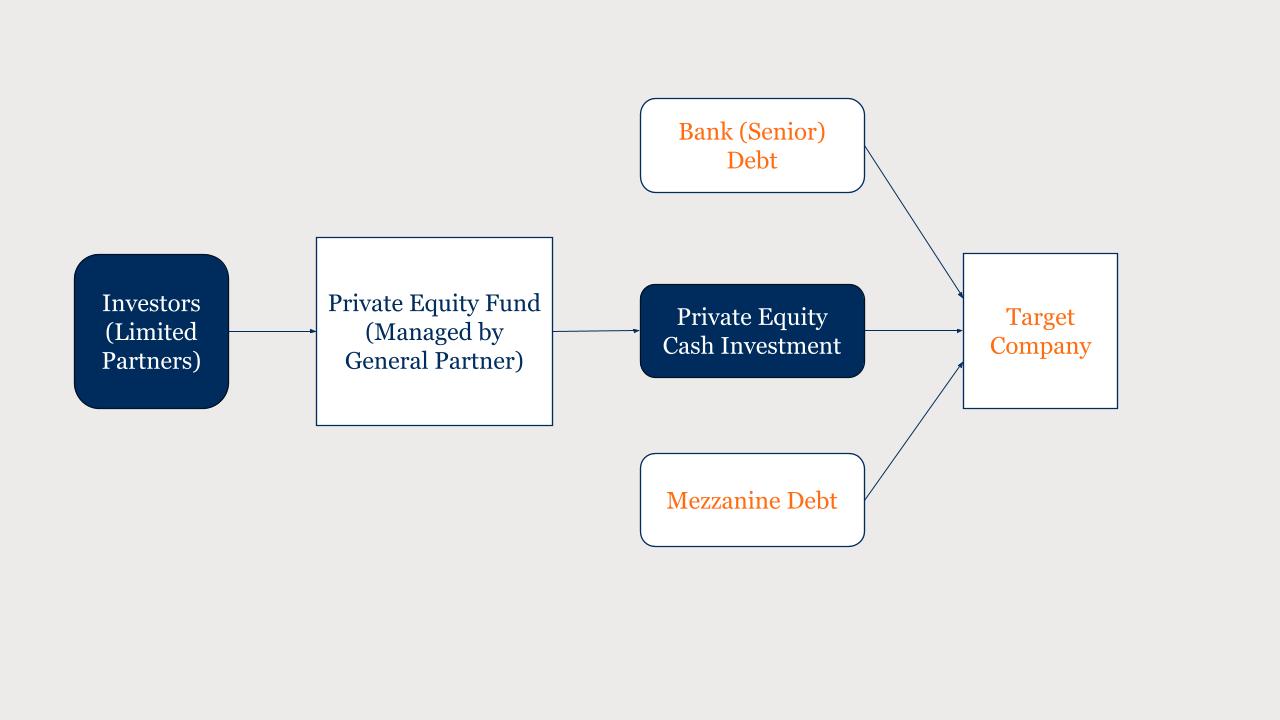

Private equity firms often play a significant role in management buyouts by providing equity investment and expertise. They work closely with management teams to structure deals, conduct due diligence, and develop growth strategies for private businesses.

The Role of Private Equity Firms in MBOs

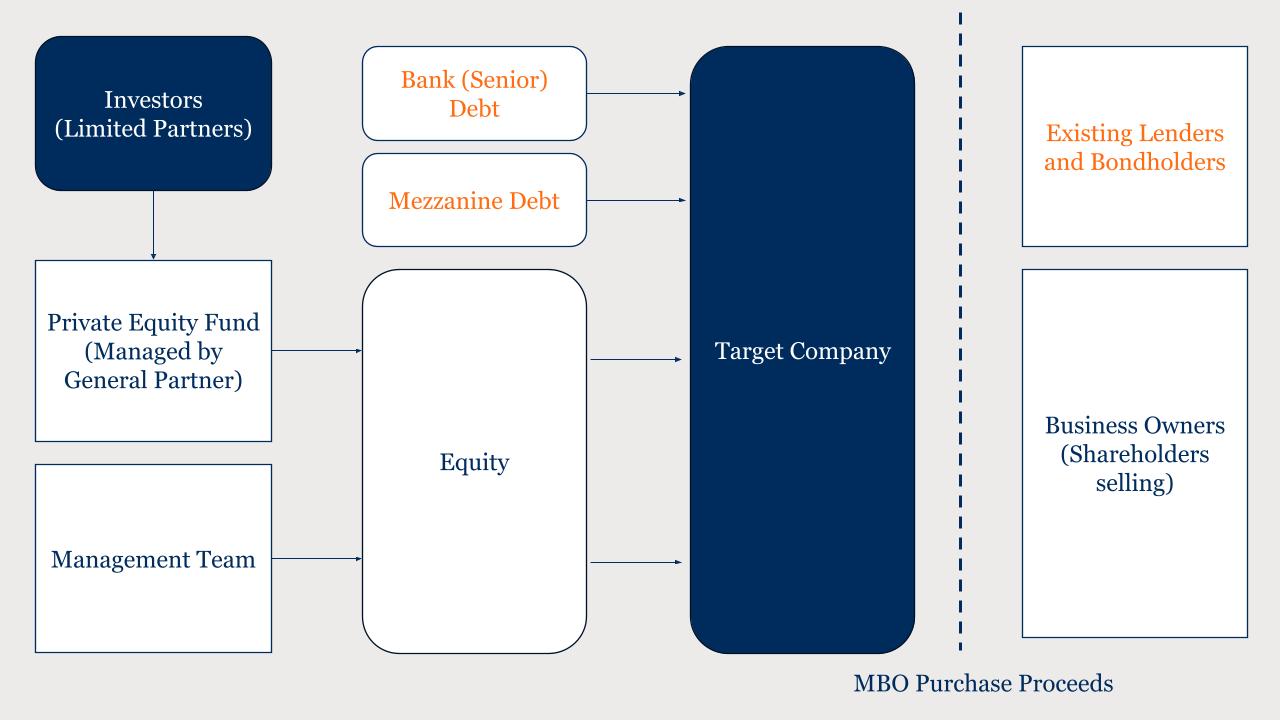

Private equity funds pool capital from various investors to acquire and manage a portfolio of businesses, often including management buyouts. These funds typically provide management teams with financial and operational support to drive growth and create value.

The Management Buyout Process

Steps Involved in a Management Buyout

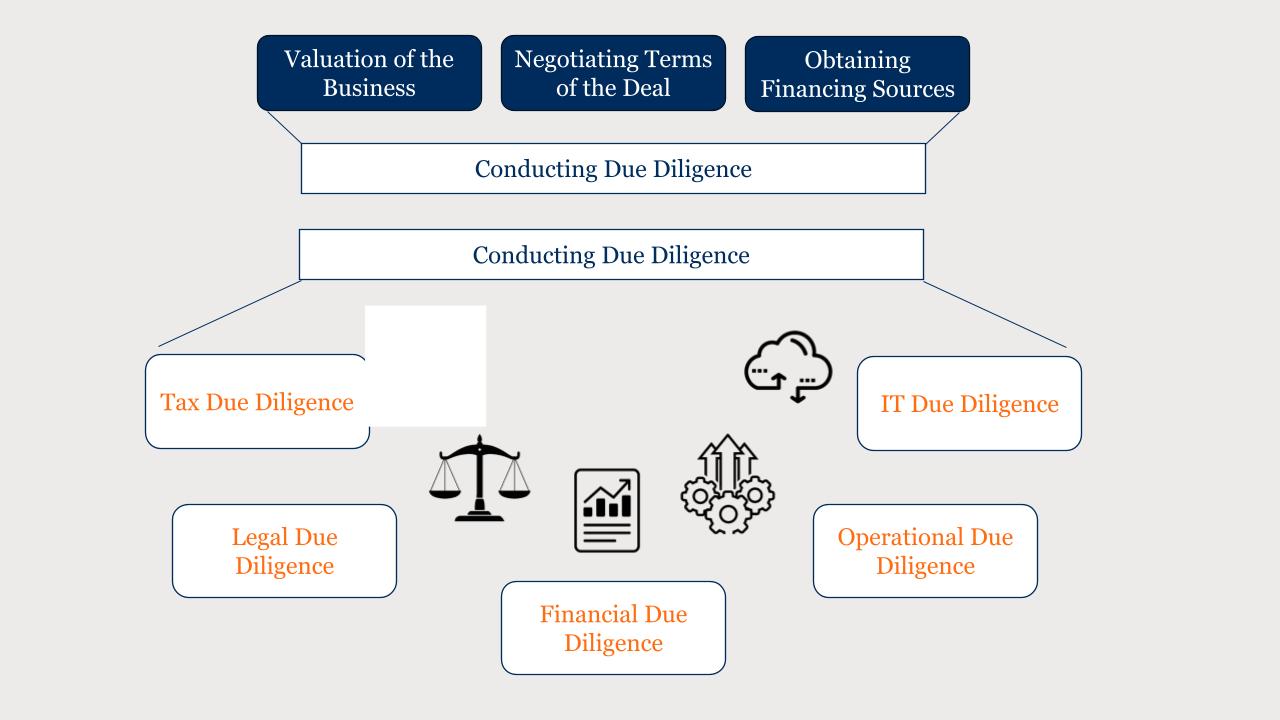

The MBO process generally involves the following steps: valuing the business, negotiating the terms, conducting due diligence, obtaining financing, and closing the deal. Throughout this process, the management team must effectively communicate with the seller and financial partners.

Due Diligence: A Critical Component of MBOs

Due diligence is essential in MBOs, as it helps the management team identify potential risks, assess the company’s financial health, and determine a fair purchase price. This process often includes a detailed financial analysis, legal review, and examination of the target company’s operations and market position.

Typically, within the timeline of any deal, preliminary due diligence would be undertaken to assess whether a target company suits the investment criteria, as the advertised company would have materials advertised to potential buyers. A non-binding indicative bid would follow. Further due diligence would then be undertaken in detail before placing a binding bid, to which confirmatory due diligence would also be conducted before the deal’s completion.

Financing the MBO

Debt Financing: A Key Element in Management Buyouts

When debt financing is used to fund the acquisition, these deals are categorised as leveraged management buyouts. This involves borrowing significant capital from banks or other financial institutions and repaying the loan over time. Debt financing allows the management team to retain control of the company, as they do not need to sell equity to investors.

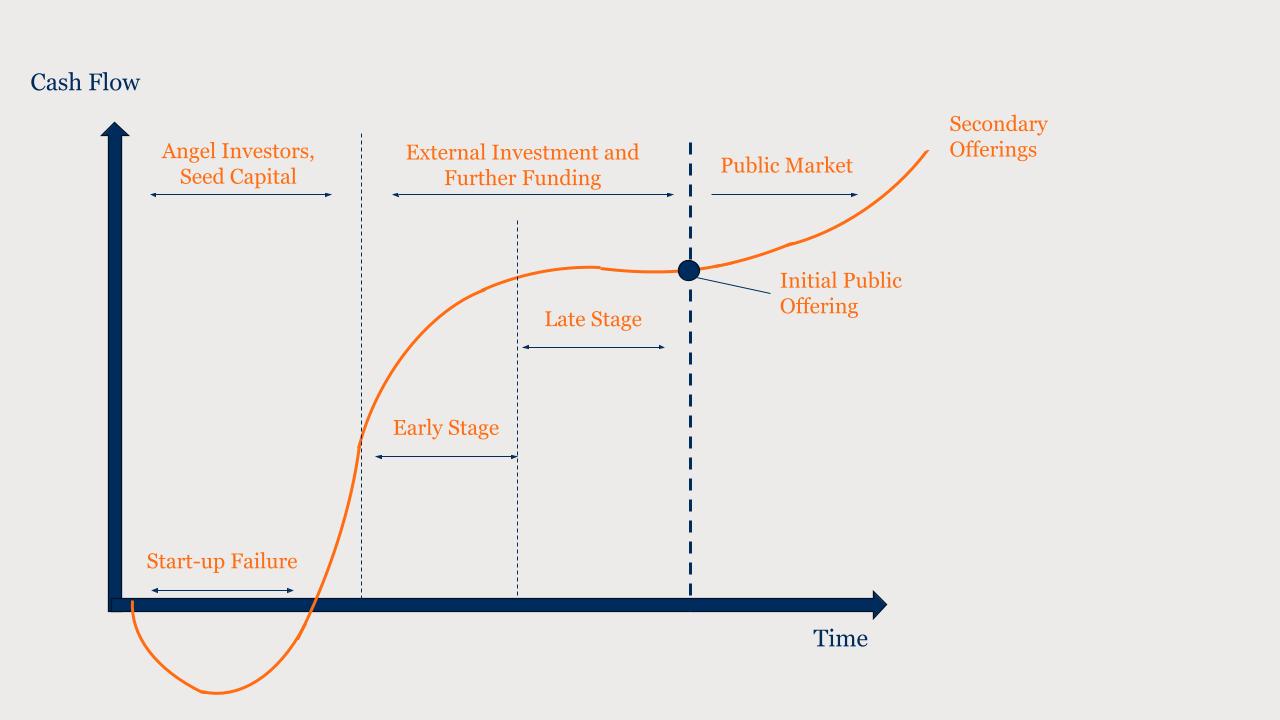

The J-curve in the above graph displays the typical private equity fund 10-year investment vehicle, with the first half of this period being focused on investment and the next half followed by divestment. Primary investors would be involved in activities from start to end.

In contrast, secondary investors would typically enter in the middle of the cycle, in this case, between the fourth and sixth years. In this process, the net cash position also reflects the debt funding undertaken to grow investments, whereby operational leverage would, in turn, lead to increased profit distributions as debt is paid down.

Private Equity Financing: How it Works

Private equity funds involve partnering with a private equity firm to fund the management buyout. The firm provides capital in exchange for an equity stake in the company. This partnership offers financial support and expertise, which can help drive growth and increase the company’s value.

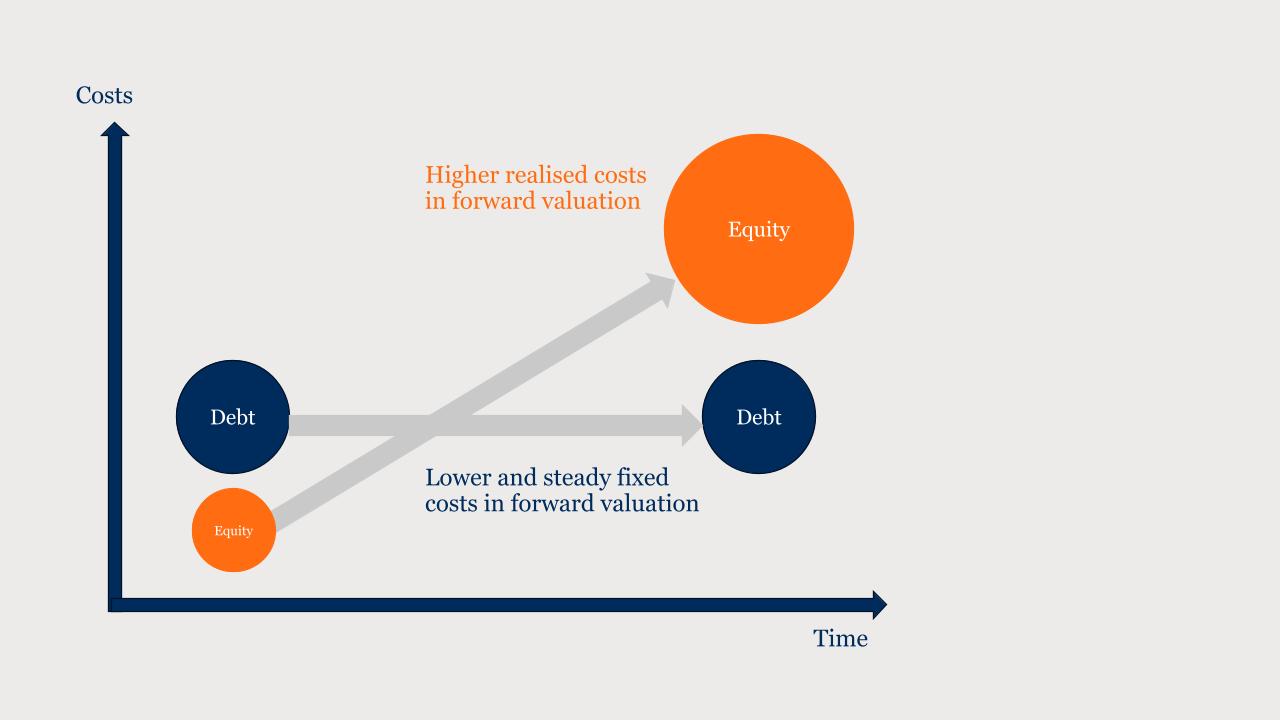

In the context of MBOs, the choice between debt and equity financing holds significant implications for the company’s financial structure and prospects. While debt financing offers lower and more stable fixed costs in forward valuation, equity financing tends to incur higher realised costs due to its variable nature and the demands of investors within the private equity management buyout landscape.

Debt financing is commonly utilised in MBO transactions due to lower and more consistent fixed costs during forward valuation. This stems from several factors inherent to debt instruments such as loans or bonds. Firstly, the regular interest payments associated with debt are predetermined and fixed over the loan’s duration, ensuring a predictable expense for the company.

Furthermore, debt holders maintain a priority claim on the company’s assets in the event of bankruptcy, incentivising them to accept lower returns in the form of fixed-interest payments. Additionally, the tax shield from interest payments further reduces the effective cost of debt financing.

On the other hand, equity financing would result in higher realised costs during forward valuation due to its variable nature and investor expectations. Equity investors would anticipate returns commensurate with the company’s performance. This often translates into elevated costs for the company during growth or profitability, as shareholders anticipate dividends or capital appreciation. The sharing of ownership and control can increase perceived risk among investors, who would seek a higher rate of return to offset this risk.

Seller Financing: An Alternative Financing Option

Seller financing is another option in which the seller agrees to accept a portion of the purchase price as a promissory note, which will be repaid over time. This method can help facilitate a deal when traditional financing is unavailable, or the seller prefers to maintain an ongoing relationship with the company.

Family Business Considerations

Family Business and MBOs: A Unique Dynamic

Family businesses considering a management buyout face unique challenges and opportunities. Succession planning, family dynamics, and preserving the company’s legacy are often critical factors in the decision-making process.

Succession Planning and MBOs in Family Businesses

An MBO can be an effective succession planning tool for family businesses. By transitioning ownership to a dedicated management team, the family can maintain the company’s legacy while ensuring continued growth and success.

Challenges and Opportunities for Family Businesses in MBOs

Family businesses embarking on a management buyout must navigate complex emotional and financial dynamics. Open communication, professional advice, and clear objectives can help overcome these challenges and seize the opportunities a management buyout presents.

Successful MBOs and Business Operations

Key Factors for a Successful MBO

A successful management buyout depends on several factors, including a strong management team, clear objectives, effective communication, robust financial planning, and a supportive network of financial partners. A thorough understanding of the company’s operations, market position, and growth potential is essential.

The Impact of MBOs on Business Operations

A successful management buyout depends on several factors, including a strong management team, clear objectives, effective communication, robust financial planning, and a supportive network of financial partners. A thorough understanding of the company’s operations, market position, and growth potential is essential.

Long-Term Management Buyout Success: Lessons Learned

To achieve long-term success following an MBO, the company’s management team must remain focused on its strategic objectives, adapt to market changes, and continuously improve operational efficiency. Regular communication with stakeholders, ongoing performance monitoring, and a commitment to innovation are also crucial.

Alternative Options:

Management Buyouts and Management Buy-Ins

Other options include Management Buy-Ins (MBIs). While an MBO occurs when an external management team joins the existing management team to acquire the company, a management buy-in involves an external management team purchasing the company without the involvement of the existing management team.

Management Buyout Case Study

In 2013, Dell Inc., a multinational computer technology company, underwent a management buyout (MBO) led by its founder and CEO, Michael Dell, and private equity firm Silver Lake Partners. The MBO marked a significant shift for the company, moving it from public to private ownership. This smooth transition aimed to allow Dell more control over executing its strategic initiatives while reducing the pressures of public markets. This case study will explore Dell’s MBO, its implications on the company’s success, and its overall success in achieving its objectives.

Key Aspects of the MBO

Structure and Financing: The deal, worth approximately $24.4 billion, was financed through a combination of equity contributions from Michael Dell, Silver Lake Partners, and MSD Capital, alongside debt financing from several banks. Michael Dell’s equity stake in the company increased to 75%, allowing him greater control over the company’s strategic direction.

Transaction Rationale: The MBO aimed to address Dell’s challenges in the evolving technology landscape, including increasing competition from mobile devices, declining PC sales, and the need to adapt to cloud computing and enterprise solutions. The transition to private ownership allowed Dell to focus on long-term strategies, such as investing in research and development, without the short-term pressures of meeting quarterly earnings targets.

Employee Impact: The MBO was generally well-received by employees, as it brought a renewed sense of direction and stability to the company. Dell also maintained that no major layoffs would result from the buyout, which helped ease employee concerns.

Impacts of the MBO

Strategic Shift: Dell pursued its strategic transformation more aggressively under private ownership. The company shifted its focus from consumer hardware to enterprise solutions, investing in research and development and making key acquisitions in cloud computing, cybersecurity, and data analytics.

Innovation and Growth: Dell’s renewed focus on innovation has led to developing new products and services, enabling the company to regain its competitive edge. The shift towards enterprise solutions has also opened up new revenue streams, contributing to Dell’s growth in recent years.

Financial Performance: Dell’s economic performance has improved since the MBO, with the company witnessing increased revenues and profitability. The focus on enterprise solutions has allowed Dell to weather the decline in the PC market better. At the same time, investments in research and development have helped drive innovation and new business opportunities.

Overall, Dell’s management buyout has been a success. The transition to private ownership allowed the company to execute its strategic transformation more effectively, enabling Dell to adapt to the changing technology landscape and maintain its competitive edge. The MBO also alleviated the pressures of public markets, allowing Dell to focus on long-term growth and innovation. As a result, Dell has witnessed improved financial performance and stability, positioning the company for continued success in the years to come.

Conclusion:

Navigating the Complex World of Management Buyouts

MBOs can be rewarding yet complex for sellers and the management team. Thorough planning, expert advice, and effective communication are vital for a successful outcome.

The Value of Expert Advice and Support in MBOs

Engaging professional advisors such as accountants, lawyers, and financial experts can provide invaluable guidance and support throughout the MBO process. They can help navigate the deal’s complexities, ensure compliance with legal and regulatory requirements, and facilitate a smooth ownership transition.

By understanding the intricacies of management buyouts and leveraging the expertise of professional advisors, business owners can successfully navigate this exit strategy and achieve the desired outcome for themselves and their companies.

By understanding the intricacies of management buyouts and leveraging the expertise of professional advisors, business owners can successfully navigate this exit strategy and achieve the desired outcome for themselves and their companies.