Introduction – maximising value from the capital markets.

Extracting maximum value from the capital markets can provide a much-needed boost for businesses to achieve long-term growth, changing the course of their future. Yet, amidst the turbulent journey of being a business owner, making time for other areas, such as funding, is often difficult. However, to attract any investment into a business, business owners must allocate adequate effort and resources to prepare themselves for this process effectively.

What is capital raising?

Capital raising is a common process for those seeking access to more funding, referring to raising extra money from external sources. By successfully raising capital, businesses can access the cash they need to improve their offerings and services, fund further growth, and tap into a network of professional expertise and resources to support their strategic expansion.

Risks of poor preparation

However, if a business is poorly prepared, investors may undervalue the business, forcing owners to accept offers that are less than what the business is worth. Moreover, without a strong and clear growth plan, management team, and financial position, investors may hesitate to take on a complex and uncertain business. Further, an unsuccessful investment round may tarnish the business’s reputation, flagging a network of investor issues, poor preparedness, and thus low investment viability. Failure to prepare well at the right time will lead to a missed opportunity for growth, ultimately wasting the time and costs required during the capital raising process.

This article will outline the key areas businesses need to focus on to avoid the consequences of failed capital-raising processes, explaining how business owners can set themselves up for success and make investing in their business an attractive option in the eyes of investors.

Business Plan

Business Plan

When engaging investors, successful business owners must present a clear plan for how their business will grow moving forward, often pivotal to raising capital and attracting investors.

This involves various paramount elements, such as a digestible executive summary, company description, market analysis, competitive landscape, product or service overview, marketing roadmap, management team analysis, operational structure, financial plan, and detailed appendix. By portraying a clear story and vision for potential investors, business owners can enhance investor trust and create strong engagement, maximising funding success and demonstrating investment viability.

To read more on creating a best-practice business plan to raise capital well, refer to our blog post-Key Elements of a Winning Business Plan for a Successful Capital Raise.

link: Key Elements of a Winning Business Plan for a Successful Capital Raise – Greenwich Capital Partners

Key Staff and Succession

Key staff and effective succession planning are the pillars of successful businesses, with a lack of quality or loyalty threatening long-term success and sustainability. Investors want to see that management is committed to growing the business, with the retention of talent and skilled leaders being essential for stability. Investors will be pouring a substantial amount of time, money, and trust into the team, so they need to be confident in its ability to execute the business plan.

Selecting who to retain and how

Businesses must take the time to consider how they can retain key staff and plan for succession. Whether it be senior executives, star performers, or even less senior roles, businesses must first identify which staff are critical to their success and operations. Importance to the firm can be evaluated upon various factors, such as technical abilities, business knowledge, contingent relationships, and their overall importance to the business. Then, taking steps to retain and motivate these staff is pivotal. Although the most common approach is offering greater financial benefits, it is important to tailor retainment methods to the ambitions and mind-set of each key staff, which can be extended to non-financial benefits such as flexible working arrangements or opportunities for career growth.

Dangers of poor succession planning

However, inevitably, there may be shifts in key staff; hence, investors want to see how the business plans to manage the change, ensure a seamless transition of responsibilities, and maintain culture and values. Having a considered plan for succession can eliminate a range of risks, such as key main risks whereby businesses become vulnerable if a key manager leaves due to a reliance on their expertise, connections, or responsibilities. Moreover, the financial instability, possible loss of business, and costs of integrating a new senior staff member can substantially impact a business. By ensuring there is always a talented and capable employee ready to take on the mantle of a more senior position, businesses can protect themselves against both planned and unexpected staff changes.

Moving forward

Analysing gaps and areas for improvement within each of these individuals is an ongoing process that must be paid close attention to periodically and contemporarily. By taking proactive steps to prepare these candidates through targeted training, mentorship, and development opportunities, businesses can ultimately shield themselves from losing key staff, creating investor confidence that the business will continue to grow and succeed.

Read more on Succession Planning in our article: Succession Planning? 6 Steps to Success.

Business systems and processes

Effective business systems and processes are the unsung heroes when running a successful and growing business. Showing investors that a business is well-run and easy to understand can alleviate doubts and help them assess business value. Documenting systems and processes indicates that a business has taken the time to optimise business operations, providing investors with a concise overview of how a business operates whilst helping them understand the business model.

Systemising processes

The sustainability and efficiency of business growth can be improved by outlining processes so anyone can follow them, thus eliminating any reliance on personal goodwill and reducing space for errors. Documenting processes also make it easier to identify and protect any proprietary information, trade secrets, or forms of intellectual property, which may warrant creating a confidentiality agreement. Additionally, systemising processes can give investors a clear roadmap of how your business operates, which can be supported by the continuous review of KPIs and active management of risks.

In doing so, depicting an operational predictability and reliability image can show investors that a business possesses the infrastructure, knowledge, and capabilities to handle sustained growth and business change, maximising efficiency and sustainability.

Legal structure

Setting up a business so investors can seamlessly invest can be crucial yet complex. The legal structure of a business can help investors clearly understand how they can integrate themselves into the business and safeguard their investment. Ensuring the current legal structure is well-positioned for any investor to come in, and understanding where the investor would fit in both on the day-to-day and financially, can help businesses effectively select and onboard the right investor.

Other implications ranging from intellectual property, liabilities, sale options, and the current share structure should be revisited and summarised ahead of funding endeavours, contributing to the reduction of unnecessary legal complexity.

Businesses with multiple shareholders should seek to create a shareholder’s agreement that outlines the rights and responsibilities of each shareholder. This can help avoid disputes, protect the rights of different shareholders, and project an image of unity to investors, including the current ownership structure and voting rights of shareholders, how board members are selected, dispute resolution procedures, and how shares can be bought, sold, or transferred.

Financial Statements

Up-to-date financial statements are essential for investors to assess a company’s financial health, make informed investment decisions, and manage risk. They provide a timely picture of a company’s financial performance, profitability, and stability, enabling investors to gauge its growth prospects and align their investments with their goals and risk tolerance. Financial statements also facilitate benchmarking, allowing investors to compare companies within the same industry and identify those with strong financial performance.

Moreover, they reveal early warning signs of financial distress, empowering investors to make informed decisions about holding, reducing, or selling their investments. By promoting transparency and accountability, up-to-date financial statements foster investors’ trust and confidence while ensuring compliance with regulatory requirements.

Valuation

Before seeking external financing, businesses should thoroughly assess their financial health and determine their fair market value. Investors typically evaluate a company’s pre-money valuation, representing the business’s worth, before any external funding.

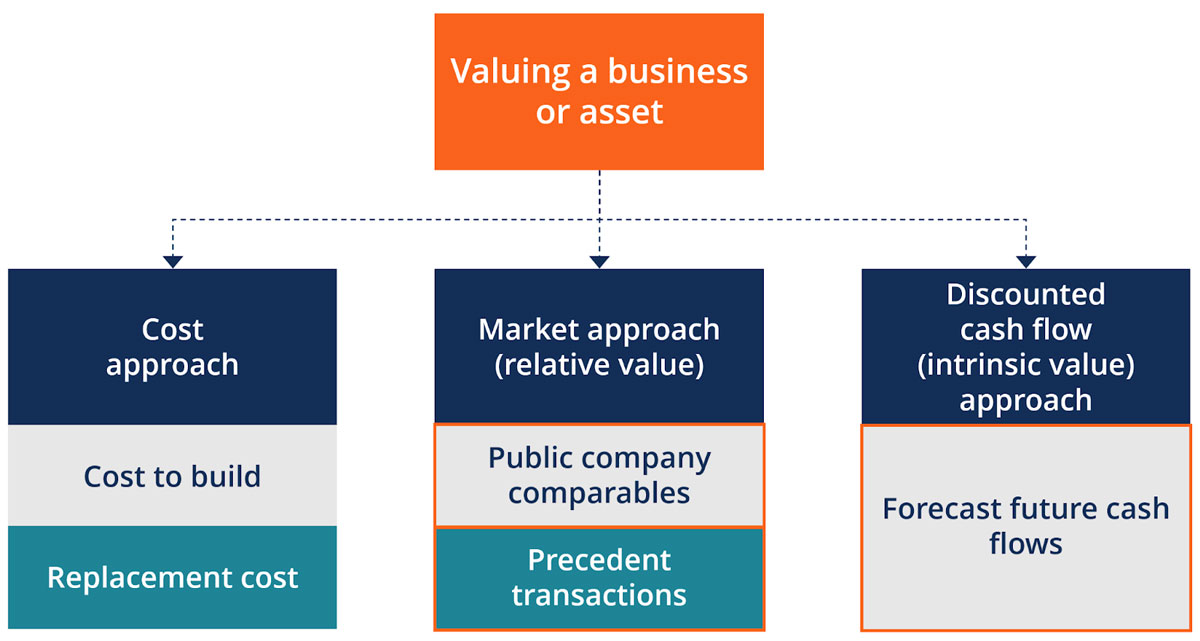

To create such a company valuation, a common approach is an (intrinsic) discounted cash flow model, which estimates the present value of a business’s future cash flows. Additionally, the (relative) comparative approach, or market approach, involves analysing comparable companies and precedent transactions within the same industry or sector to determine the business value.

Alternative Valuation Methods

In addition to this standard approach, there are several alternative methods for valuing a company, such as:

Asset-Based Valuation: This method assesses the value of a business’s assets, such as equipment, inventory, and intellectual property, useful for those with many tangible assets.

Berkus Approach (cost approach): This method focuses on the cost of replacing a business’s assets, providing a floor value for the business.

Raise-Restricted Approach: This method estimates the maximum capital a company can raise through external financing.

Liquidation value: This method values a company based on the cash generated if the business were to sell its assets and pay off all its outstanding debts.

Businesses can increase their chances of success during capital-raising endeavours by carefully preparing accurate financial statements, establishing a fair and defensible valuation, and transparently communicating financial performance.

Governance

Governance

Creating a system of rules, policies, and procedures that govern how a business is run ensures the business can be run in the best interests of relevant stakeholders fairly, enhancing the efficiency of operations and decision-making.

Governance is how power is used throughout a business, from the board of directors’ relationship with management to the defined values in place. Good governance looks like having a dynamic board that can critically analyse the board and company at a higher level, talking about strong and weak areas objectively and data-oriented.

Importance of governance from an investor’s perspective

Reduced risk and enhanced returns

Good governance practices can help reduce the risk of investing in a company by ensuring that the company is well-managed and has a sound risk management framework. This can lead to enhanced returns for investors over the long term.

Increased transparency and accountability

Good governance practices promote transparency and accountability, which helps investors to make informed investment decisions. Investors can be confident that their money is being managed responsibly when they invest in a company with good governance practices.

Protection of shareholder rights

Good governance practices protect shareholder rights by ensuring shareholders have a voice in the company and can hold the board of directors accountable. This can help to prevent abuses of power and ensure that the company is acting in the best interests of shareholders.

Enhanced reputation and stakeholder satisfaction

Good governance can enhance a company’s reputation and increase satisfaction among stakeholders, including shareholders, employees, customers, and the community. This can make the company more attractive to investors and can also lead to increased sales and profits.

In short, good governance is essential for investors because it can help them achieve their financial goals while ensuring that their investments are made responsibly and ethically.

Here are some specific examples of how good governance can benefit investors:

- A company with a strong track record of good governance is less likely to be involved in accounting scandals or other corporate misconduct. This can protect investors from losses and help preserve the company’s value.

- A company with a well-defined risk management framework can better identify and mitigate risks. This can help to protect investors from losses and can also help to ensure that the company can achieve its long-term goals.

- A company with a transparent board of directors is more likely to make decisions that are in the best interests of shareholders. This can help to increase investor confidence and can also lead to higher returns for investors.

Conclusion

Taking the next step to galvanise the growth of a business can be a daunting and intricate process that differs for every business. By proactively following the tips above, businesses can position themselves well for this journey and catalyse sustainable growth to unleash their long-term potential.